Building with Confidence: Trust Foundations

Building with Confidence: Trust Foundations

Blog Article

Securing Your Assets: Depend On Foundation Experience at Your Fingertips

In today's complex economic landscape, guaranteeing the safety and development of your properties is extremely important. Count on structures offer as a cornerstone for guarding your wealth and tradition, offering a structured method to possession defense.

Value of Depend On Structures

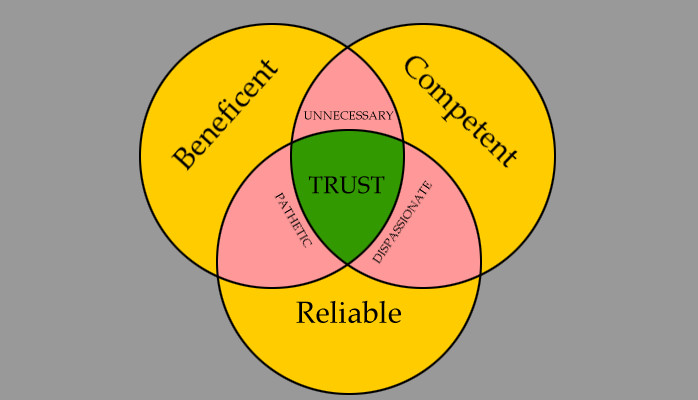

Depend on structures play a critical duty in developing reputation and cultivating solid connections in different professional setups. Structure depend on is necessary for services to flourish, as it forms the basis of effective cooperations and partnerships. When count on is present, people feel much more confident in their communications, causing enhanced productivity and performance. Depend on foundations act as the foundation for ethical decision-making and clear communication within organizations. By focusing on count on, businesses can produce a positive job culture where staff members really feel valued and respected.

Advantages of Specialist Support

Structure on the structure of depend on in expert connections, seeking expert assistance provides indispensable benefits for individuals and organizations alike. Specialist advice gives a wide range of understanding and experience that can assist navigate complex financial, lawful, or calculated difficulties effortlessly. By leveraging the experience of specialists in different fields, individuals and companies can make educated decisions that align with their objectives and ambitions.

One significant benefit of expert guidance is the capability to access specialized expertise that might not be readily offered or else. Professionals can use insights and viewpoints that can cause innovative remedies and chances for growth. In addition, working with specialists can assist mitigate dangers and uncertainties by giving a clear roadmap for success.

Additionally, specialist assistance can conserve time and resources by simplifying processes and staying clear of expensive blunders. trust foundations. Professionals can supply customized suggestions tailored to certain needs, making sure that every choice is knowledgeable and critical. Overall, the advantages of specialist assistance are diverse, making it a valuable possession in securing and taking full advantage of properties for the long-term

Ensuring Financial Safety

Guaranteeing financial protection entails a complex technique that includes various aspects of wide range administration. By spreading investments throughout various possession classes, such as supplies, bonds, genuine estate, and commodities, the threat of substantial monetary loss can be mitigated.

In Source addition, preserving an emergency fund is important to guard versus unforeseen expenditures or earnings disruptions. Specialists suggest establishing apart three to 6 months' worth of living expenditures in a fluid, easily obtainable look at more info account. This fund serves as an economic security net, giving comfort throughout rough times.

Frequently reviewing and changing financial plans in feedback to altering conditions is likewise extremely important. Life events, market variations, and legislative adjustments can impact monetary security, highlighting the relevance of ongoing examination and adaptation in the quest of lasting financial protection - trust foundations. By executing these approaches attentively and regularly, people can strengthen their financial footing and job in the direction of a more safe future

Guarding Your Assets Successfully

With a strong structure in place for monetary protection through diversification and emergency situation fund upkeep, the following crucial step is securing your properties effectively. image source Protecting possessions includes shielding your wealth from prospective dangers such as market volatility, economic slumps, legal actions, and unforeseen expenses. One effective technique is possession allowance, which entails spreading your financial investments throughout numerous property courses to minimize threat. Expanding your profile can assist minimize losses in one location by balancing it with gains in an additional.

In addition, establishing a depend on can provide a safe and secure method to shield your possessions for future generations. Trust funds can assist you regulate how your properties are distributed, decrease estate taxes, and shield your wealth from lenders. By implementing these methods and seeking expert advice, you can protect your properties effectively and protect your economic future.

Long-Term Asset Security

Long-term asset protection entails implementing measures to safeguard your properties from numerous hazards such as financial slumps, legal actions, or unanticipated life occasions. One vital element of long-term asset protection is establishing a trust fund, which can supply substantial benefits in protecting your assets from financial institutions and lawful conflicts.

Additionally, expanding your investment profile is an additional essential approach for long-term possession defense. By taking a proactive technique to long-term possession defense, you can safeguard your riches and give financial safety for on your own and future generations.

Conclusion

Finally, trust foundations play a critical role in securing properties and ensuring monetary protection. Expert assistance in developing and taking care of trust fund structures is important for long-lasting property defense. By making use of the proficiency of experts in this area, people can properly safeguard their assets and prepare for the future with confidence. Trust foundations give a strong structure for shielding riches and passing it on future generations.

Report this page